Implementation of Group Personal Accidental Insurance Policy in Jammu and Kashmir.

- The J&K Government has implemented the Group Personal Accidental

Insurance Policy for Employees of J&K Government (Gazetted and Non

Gazetted) including Employees of PSUs/Autonomous Bodies/Local

Bodies/ Universities, Daily Rated Workers, Consolidated/Contractual/Adhoc employees/Contingent paid workers and SPOs against accidental death or disability for 3rd year, commencing from midnight 2nd of December 2021 to 1st of December

2022, as per the agreement already executed between the

Government of Jammu and Kashmir and M/s. Oriental Insurance

Company Ltd. for an Insurance cover of Rs. 10 Lakhs (Rupees Ten

Lakhs Only) for each employee.

- Since the policy is compulsory in nature, it shall be personal

responsibility and liability of the DDOs/ HODs/ Managing Directors/

Chief Executive Officers/ Registrar of Universities to register every

employee under the scheme so that no employee is left out. The Nodal

Officer shall not accept any intimation of an accidental death or

disability of any employee for processing insurance payments under

this scheme unless the concerned DD0 certifies that the premium

amount has been deducted from the concerned employee in time.

However, wherever due to any administrative or financial problem, the

DDO could not deduct the premium of his employee(s) from the salary

of the month of December 2021, he shall immediately deposit/remit

the prescribed premium against the proper Head of Accounts in the

concerned Treasuries through challan on or before 15th of January

2022 after collecting the premium from their left out employees to

bring them under the Insurance coverage. - Accordingly, the Treasury Officers are also directed to allow/permit the

remittance of the premium in cash through challan in respect of DDOs

of PSUs/Autonomous Bodies etc. and such DDOs who faced

administrative or financial constraint in the mandatory deduction of the

premium at source from the salaries of their employees for the month

of December 2021 towards Group Personal Accidental Insurance Policy.

Besides, The Treasury Officers are also directed not to entertain salary

bills for the month of December, 2021 without premium deduction.

- The employees, who are deputed outside the territorial limits of J&K,

are also covered under the instant policy and they shall remit the

prescribed premium through challan in the J&K Government treasuries on or before 15th of January 2022. - In case of new appointees, DDO shall collect the premium amount

from the new appointees on the very first day and deposit/remit the

prescribed premium against the proper Head of Accounts in the

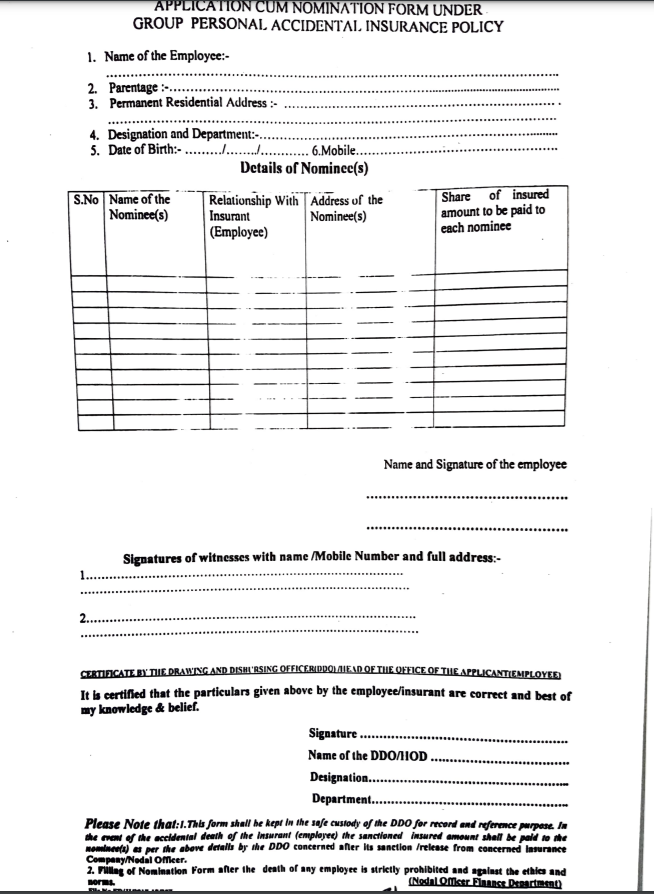

concerned Treasuries through challan. - All the employees covered under the scheme are required to fill up a

Nomination Form as already prescribed and annexed as Annexure-A,

giving all the relevant details of their nominee(s) so that the insurance

payments are made to such nominee(s) only in the case of accidental

death, by concerned DDOs . The Nomination Forms shall be retained

by the DDOs concerned and kept in their safe custody for reference

and record as and when need arises. It should be noted that filling

of Nomination Form after the death of any employee is strictly

prohibited and against the ethics and norms. - To ensure speedy settlement of insurance claims, intimations of

accidental deaths or partial/permanent disabilities should be promptly

sent to the Nodal Officer, Finance Department directly by the

concerned DDO immediately along with attested copies

mentioned documents

a. FIR/Police Final Report.

b. Death Certificate.

c. Post Mortem Report.

d. Disability certificate (in case of disablement) indicating the permanent nature of disablement with percentage.

Note: the disablement certificate should not be conditional.

- Official account Number of the concerned DDO.

- Premium Deduction Certificate to be issued by concerned DDO carrying reference of Treasury Voucher No. and date of remittance of premium.

It shall be the responsibility of DDO to:

- Check and satisfy him/ herself about the genuineness of an accidental claim. Any deviation will be the personal responsibility of the DDO and the consequences arising out of such deviation. This may strictly be noted.

- Intimation along with all relevant documents regarding the accidental death/disablement should be furnished to the Nodal Officer, Finance Department through Registered Post/Speed Post only with acknowledgement due or through a messenger against proper receipt. The Nodal Officer, Finance Department shall not be held responsible, if any intimation sent by any other means gets lost in transit.